Welcome to 2021!

Although the signs were there, I think it is safe to say that none of us wanted 2021 to begin with the pricing reality we all are facing. Years of underbuilding, low interest rates, and capacity constraints on the production side continue to contribute to historically high pricing. We had some erosion in the 4th quarter of 2020 as the high prices kept many wholesale and retail participants out of the market. Some simply can’t afford to carry the high cost of inventory through year-end, some get taxed on it, and anyone that is business savvy realizes it cuts down on overall annual profitability. When things gets down to it though, even if people can afford it, there simply isn’t enough production to put inventories where they need to be.

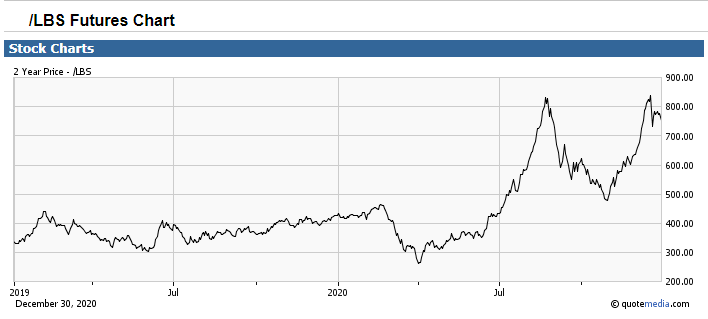

This time of year, weather patterns typically slow sales down a bit, but can also provide logistical challenges like longer lead times. In our region, we haven’t seen many major winter weather patterns, which exacerbates the problems. Sometimes you just need a good snowstorm to cool things off! Seriously though, many of the commodity products we receive deliver by rail through remote parts of North America and they often get delayed this time of year. The following graph really shows we are right back at the highs of the year.

Here are some headlines for specific products, but overall extended lead times and product shortages are going to be the norm for Q1 and likely into Q2.

FOREST PRODUCTS

SYP and treated out of the south are moving upwards rapidly. COVID-related production constraints paired with increased seasonal demand (treaters typically build stock this time of year) have pushed that market upwards. Many of the products we had issues with last year — like treated decking and anything 18′ or longer — are still going to be an issue this year.

Dimensional lumber also bumped up again and is hanging out around the all-time highs we formed last year. Futures market analysis also suggests supply is still tighter than demand and the dynamic may be around for a bit. Stud pricing and availability is mixed, but 2×4 and 2x6x104 5/8” are among the tightest offerings with pricing moving upward at a torrential pace. Wide dimensional doesn’t move quite at the same pace as narrow dimensional, but all offerings moved upwards abruptly when mill order files extended well into 2021.

ENGINEERED WOOD PRODUCTS

Engineered wood products such as I-joists, LSL, LVL, and rim joists are also struggling to keep up with demand. Most manufacturers are on allocation right now based on a formula from the previous year’s volume and many of them can’t keep up with their allocations. Supply-side constraints such as lack of resin or lack of 2×3 materials are a couple of major contributing factors. OSB uses a slightly different resin, but production constraints and strong demand have pushed many mill order files into March which doesn’t bode well for pricing.

EXTERIOR PRODUCTS

Lead times for roofing and siding products are extended. Exterior trim products such as LP, Miratec, and Azec are also currently on allocation with limited distributor support. On the decking side, Trex is in good shape at the moment but success will still come down to giving our team plenty of lead time on orders and projects. There are still bottlenecks with Deckorators spindles and anything aluminum in general due to the lack of aluminum recycling. Other than that, cedar is extremely tight with limited availability from almost every supplier.

INTERIOR PRODUCTS

Interior pre-hung doors are in better shape, but we are not quite out of the woods yet. Production varies day-to-day due to COVID restrictions. Most interior door companies have announced increases of 10-15% beginning January 1st which has led to an influx of orders and extended lead times. Lead times are approximately 4 weeks currently.

CABINETS

There haven’t been any major issues with cabinets but they are requiring an additional 2-3 week lead times above normal lead times.

WINDOWS

Price increases are starting to take effect and we are still experiencing severely extended lead times depending on the product. Watch expired quotes, many manufactures have increased prices and are not honoring the old ones. Silverline lead times are approximately 8-10 weeks. Andersen and Marvin lead times are approximately 4-6 weeks. MI is approximately 14-16 weeks. North Star is approximately 8 weeks.

FASTENERS

Price increases are starting to take effect towards the end of January. Availability is fair at the moment, but there may be some issues with galvanized fasteners as Q2 approaches. Galvanized products predominantly come from overseas and most of the inbound material is already spoken for. Simpson is still running consistently at 2-3 days. Locksets are in better shape but we are still seeing some availability issues with specific offerings such as Iron Black. Availability of cabinet knobs, handrail brackets, and hinge pins is healthy at this point.

This first quarter of the new year is off to a quick start. Though we are seeing delays and high pricing on a range of materials, the Zeeland Lumber & Supply team is here to help you get the products you need, when you need them. Feel free to reach out to us for more information on lead times, pricing, and status updates on the products you’re looking for.