Prices in the lumber industry continue to climb to all time high levels. At Zeeland Lumber & Supply, we are committed to constant communication with the customers we work with, and in times like these, we are doubling down on that. If you are wondering what is driving our collective reality, here are a few factors.

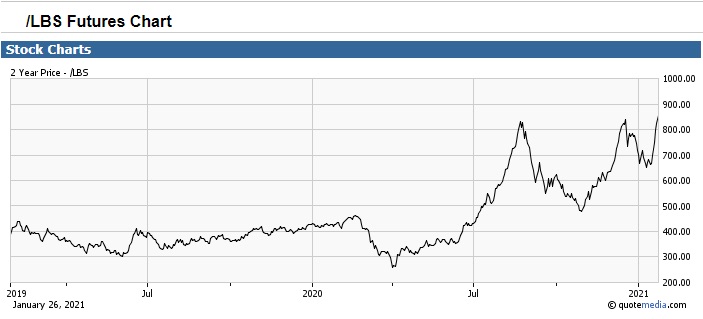

Strong demand and constant pauses in production are leading the way to the heights we are in. We continue to see amazing demand for new homes; this is coupled with winter weather that is conducive to building. At the same time, the constant pauses are due to a number of factors including: raw material shortages like resin, continued covid precautions, and forced mill shutdowns. If you look over the most recent lumber chart below, you will get a glimpse of the ride we have been on.

Here are the things you should know when planning upcoming projects for your business:

LOGISTICS IN GENERAL – Currently we aren’t having too many issues with truck/rail even with the harsher weather. Getting shipping containers to arrive on time and clear the ports has been somewhat problematic. We are facing many shipping issues such as: not enough empty containers getting back to the ports, production issues overseas, and slow operations at the ports. Any way you look at it, the lead times for containers is extended.

STUDS – The stud market loosened up briefly, but it firmed back up and pricing is rebounding quickly – this is especially true in the 104 5/8” length.

SPF/FIR/DIMENSIONAL – The price of SPF came down a bit as futures expired, but as mentioned earlier it firmed back up. Strong demand paired with mediocre production has kept the markets up. At this point, I don’t think we will really get much of a break until after the March contract expires, I believe we will see a similar situation to what we saw when the January futures expired, a brief consolidation and then higher prices again as we work our way towards spring. This week’s print shows both 2×4 and 2×6 rebounding, 2×6 had been trading at a discount and 2×4 and is now a premium.

SYP/TREATED – The SYP market never had a pause similar to SPF with prices doubling in the last 8 weeks. Long length’s, premium grade products, and decking will continue to be a struggle throughout at least the first half of the year. We are in better shape on premium decking since the last update, we received a couple of loads and our treater is starting to get their 2021 volume received.

OSB – Resin issues, production curtailments, and seasonality are fueling the market. Weyerhaeuser’s production has been shut down for scheduled maintenance. We are filling the contract loads with ¾ T&G and bringing in the other offerings from other sources. Bringing in OSB from outside the North Central Zone is extremely costly due to increased transportation costs.

EWP – LP is still on allocation and will be for the foreseeable future. We are holding our own on EWP mainly due to seasonal slowdowns. LPI’s and LVL’s are in pretty good shape, inventory is tight but trucks are showing up every week as scheduled. LVL columns are nonexistent. Overall there is very little support out of warehouse. The resin issues have completely put a halt on LSL production for the time being with LP putting all the resin they are getting into the siding and exterior trim products. To make matters worse, the resin issue as well as just overall extended lead times on OSB have crossed over into Rim Board production giving little to no availability there either. If you are planning on seeing any relief in EWP pricing, please reassess as our outlook shows pricing continue to rise well into 2021.